Navigating the Headwinds

The Current State of the Domestic Truckload Brokerage Landscape

The domestic truckload brokerage landscape, as it is today in late 2025, is a market of cautious rebalancing, technological transformation, and persistent uncertainty. After a prolonged period of a "loose" market characterized by overcapacity, the pendulum is slowly starting to swing, but the shift is measured, not sudden.

Here's a breakdown of the key trends, challenges, and opportunities shaping the truckload brokerage environment today.

The Market & Rates: A Gentle Shift

The overarching theme for the freight market is a move toward equilibrium after the massive swings of recent years.

- Capacity is Tightening (Slowly): While excess capacity is still a factor, carrier exits—driven by high operating costs (fuel, insurance, labor) and low margins—are beginning to thin the herd. This gradual reduction in available trucks is the primary driver of the market shift.

- The Inverted Rate Market is Fading: For some time, the market was "inverted," with spot rates falling well below contract rates. Recent data shows spot rates have become inflationary year-over-year, and while contract rates are also increasing (though slightly less than spot), the gap is narrowing. Analysts are forecasting an overall rise in freight rates through the end of the year and into the next.

- Muted Freight Demand: Freight volumes remain soft, a consequence of slowing consumer spending on goods, weakening industrial activity, and ongoing economic uncertainty. This muted demand is why the capacity tightening hasn't yet led to a "boom" or a return to the ultra-tight markets of the post-pandemic era.

- The Shipper's Market Persists (for now): Despite rising rates and tightening capacity, the market is still largely a "shippers' market." Shippers are enjoying relatively high tender acceptance rates and continue to have strong pricing power, putting pressure on broker margins which have dipped below historical averages for many smaller-to-midsize brokerages.

Key Challenges Brokerages Must Navigate

Survival and success in the current environment hinge on how brokerages address a few critical pain points:

- Margin Compression: This is the immediate financial challenge. The combination of fierce competition for soft freight volumes and the need to offer low prices to win contract and spot business continues to squeeze profit margins.

- The Fraud Epidemic: Freight fraud, including double brokering and cargo theft, remains a rampant and growing threat. This impacts not only a brokerage's financial health but also the critical trust with their carrier network and shippers. Robust carrier vetting and advanced security tools are no longer optional.

- Carrier Relationship Management: In a world where carriers have more options due to gradually tightening capacity, brokerages must prioritize strong, trust-based relationships. Carriers seek partners who offer timely payments, fair practices, and consistent freight opportunities.

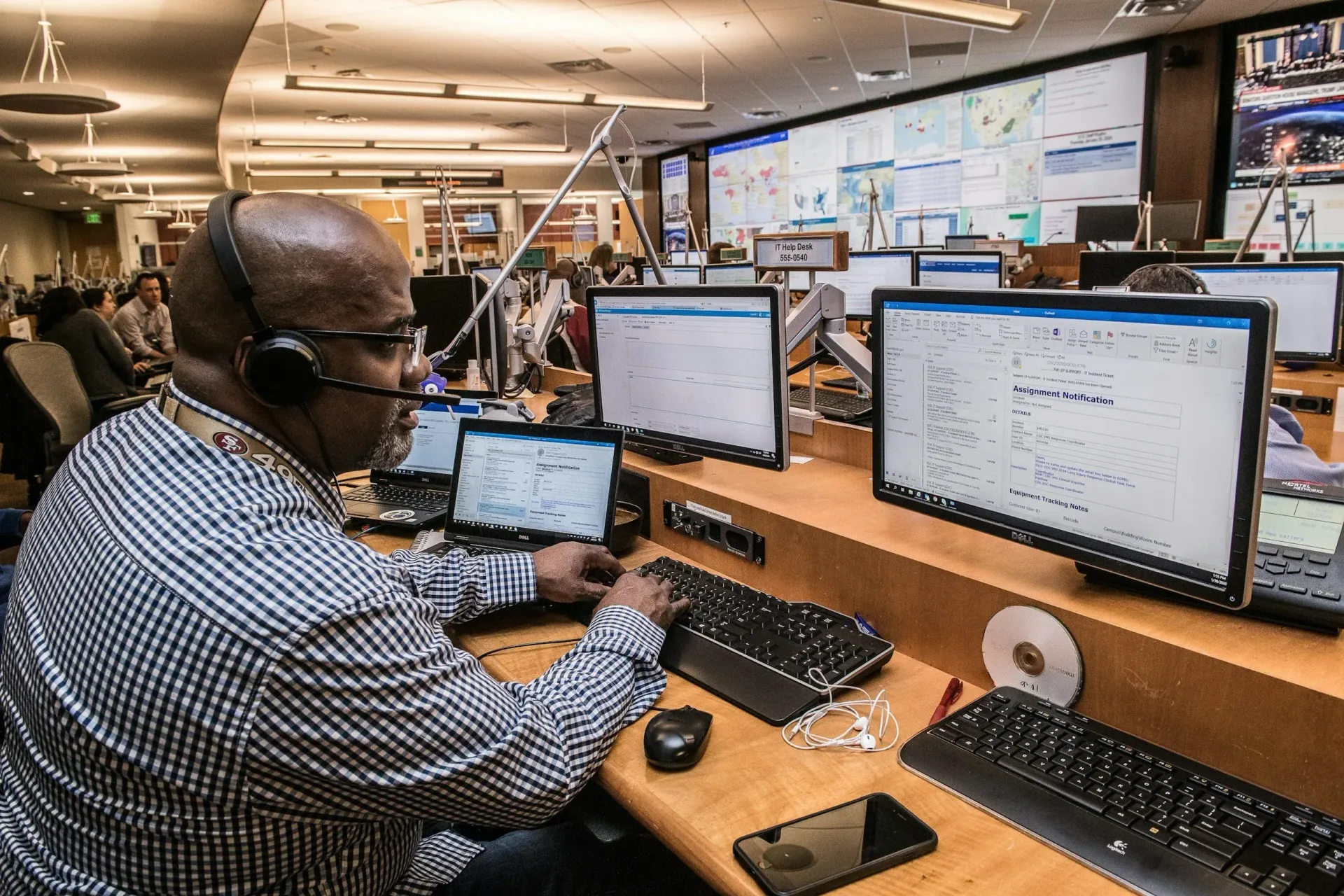

The Technology Imperative: Transformation is Underway

Technology is the differentiator that separates those who will thrive from those who will merely survive. The modern brokerage is becoming a digital-first operation.

- AI and Automation: The integration of Artificial Intelligence and Machine Learning is moving beyond a buzzword.

- Automated Load Matching: AI algorithms are now sophisticated enough to automate load-to-truck matching by analyzing cost, reliability, and equipment availability in real-time.

- Dynamic Pricing: Brokers are leveraging predictive analytics to set accurate, competitive prices that adjust quickly to real-time spot market shifts.

- Back-Office Efficiency: Automation is reducing the administrative burden, freeing up brokers to focus on relationship building and problem-solving.

- Advanced Data and Visibility: Real-time data analytics is essential for strategic decision-making. Brokers are using data-driven insights to better understand lane-specific trends, optimize their carrier networks based on performance, and provide shippers with the granular visibility they now demand.

- Fraud Prevention Technology: The use of dedicated tools for real-time carrier vetting, identity verification, and continuous monitoring is becoming standard practice to mitigate risk.

Opportunities for Growth and Success

While challenging, the current environment is forging a more resilient and sophisticated brokerage industry.

- Focus on Service and Differentiators: As capacity tightens, shippers will pay a premium for consistent service, not just the lowest rate. Brokerages that can demonstrate reliable capacity, quick problem-solving, and expertise in specialized services (like hazmat, temperature-controlled, or flatbed) will win market share.

- Strategic Carrier Network Building: Investing in high-quality, trusted carrier partners now will pay massive dividends as the market further constricts. Prioritizing fair practices, timely payments, and clear communication builds a reliable network that can deliver for shippers when capacity is scarce.

- Targeting the Mid-Market Shipper: Large shippers often command the highest leverage, but the mid-size shipper market is often overlooked. Providing this segment with tailored, high-touch service and leveraging technology to offer scalable solutions presents a significant growth opportunity.

- E-commerce and Final Mile: The continued growth of e-commerce fuels demand for flexible, on-demand trucking solutions, which is a core strength of freight brokerages.

Looking Ahead

The domestic truckload brokerage landscape in late 2025 is defined by a slow, strategic march toward a more balanced market. The days of simply brokering a load and moving on are over. The successful brokerage of today is an agile, technology-enabled partner focused on risk mitigation, operational efficiency, and building high-trust relationships.

For those who can embrace the digital transformation and outlast the current economic headwinds, the coming years promise a more stable, albeit highly competitive, playing field.